Policy Reform: Repeal the Estate Tax

High death tax puts Rhode Island economy further into grave

The Ocean State should be the ideal location to raise a family, run a business, and build an estate that endures for generations. Our state benefits when wealthy people live within our borders, expanding our tax base, paying more taxes, increasing potential investment in businesses, and making greater contributions to local charities.

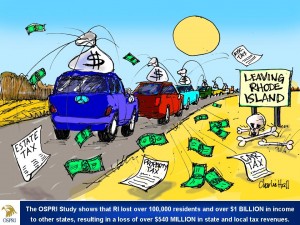

Why do we keep driving our rich to other states with one of the most punitive death taxes in the country? Financial planners openly state that they advise their wealthy clients to leave the Ocean State if they want to maximize their financial situation.

Recent analysis of migration data shows that Rhode Island is losing people and money to other states, especially Florida, which does not have an estate tax.

In fact, after Florida’s estate tax was eliminated in 2004, the average out-migration of income from Rhode Island to Florida leapt by 77 percent. Removing the estate tax would help level the playing field with Florida, and all states, and perhaps convince a few ex-residents to return home.

(click image to view larger size)

View OSPRI’s landmark “Leaving RI” report here (see page 13 for Estate Tax discussion) …

Leave a Reply

Want to join the discussion?Feel free to contribute!