BACKGROUND:

Should the hopes, dreams, and aspirations of Rhode Island families be limited by an arbitrary, politically driven budget number at the bottom of a spreadsheet? Unfortunately, our state is now suffering the consequences of such an approach, dragged-down by the progressive-left’s big-spending agenda; as projected economic growth has not materialized, leaving the state with massive budget deficits.

Failure of Budget-Centric Apporoach. Yet, for decades, state politicians have practiced allegiance to a budget that has failed its people; a budget that requires unhealthy levels of taxation and regulation. This, as opposed to the allegiance they are sworn to uphold to the people of Rhode Island.

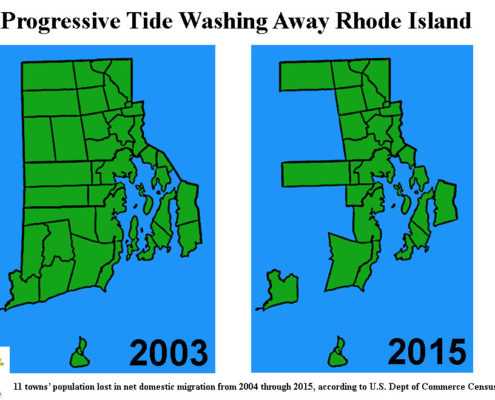

Despite the false hopes expressed by lawmakers based solely on a reduced unemployment rate, on broader measures, in 2016 the Ocean State suffered the worst business climate and the 48th rank in family prosperity in the nation. Furthermore, Rhode Island was the only state in New England to see its labor force decline in size in recent years, as hundreds of thousands of people have chosen to leave our state since 2004. This is not a recovery. The RI Center for Freedom & Prosperity maintains that the high levels of taxation and over-regulation imposed for the sake of the state budget are the primary culprit in causing this stagnant performance.

Rhode Islanders need a credible alternative to the status quo and its destructive progressive ideas. You can help.

Click here to find out more >>>

The RI Center for Freedom & Prosperity is the Ocean State’s leading voice against the wreckage caused by our state’s progressive agenda.

As the state’s leading research organization, advancing family and business friendly values… the mission of our Center is to make Rhode Island a better place to call home – to raise a family and to build a career.

While progressives value government-centric, taxpayer-funded dependency… our Center believes in the value of hard work and the free-enterprise system.

We understand that in order for more Rhode Island families to have a better quality of life, that more and better businesses are needed to create more and better jobs.

Your donation will help us fight the union-progressive movement and, instead, advocate for pro-family, pro-business policies and values.

Please make a generous, tax-deductible gift to support our Center today!

show less

It should now be plainly clear that this progressive-left, big-spending, budget-centric approach is not working. Indeed, the state budget itself, could be considered the enemy of the people! Put another way, overspending by a government that primarily seeks to perpetuate and grow itself, actually works against the best-interests of the very people it is supposed to be serving. Instead of seeking to grow prosperity, government seeks to grow itself. This approach must end.

A battle of visions. The progressive-left vision measures compassion and progress by how many people are enrolled in — and become dependent upon — public assistance programs; and by how much money is thrown at a perceived problem. Conversely, the Center believes that Rhode Island families can improve their quality of life and increase their level self-sufficiency only if more and better businesses are free to create more and better jobs and if families can keep more of their hard-earned incomes!

To realize this latter vision — and for true prosperity to be realized — the size of government via budget spending must be cut, so that taxes can be decreased.

What is really in the best interests of Rhode Island families? Is dependence on an unreliable and inefficient government what people hope and strive for? Or, should it be the American dream; where promised freedoms and opportunities abound so that we can increase our own own personal wealth and quality of life?

Deficits: An Opportunity to Reverse Course. Rhode Island’s budget spending rises every year — far beyond the rate of inflation and population growth — as lawmakers are resistant to spending cuts, even when such cuts could lead to increased prosperity for its residents! If phasing out the car tax and cutting the state sales tax to 3.0% would keep more money in the pockets of residents … and could create thousands of new jobs and better opportunities at the same time … why should any budget number stand in the way?

The state budget should be constructed to reflect the opportunities we want for our people; it should not be the tool to restrict those opportunities.

The nearly $134 million budget deficit presents a new opportunity for our state and a test for lawmakers to determine if they will be wise enough to begin to reverse this budget-centric trend, and move toward an approach that will free its families and business to become more self-sufficient. To bridge the gap, our Center urges lawmakers NOT to continue to seek to extract new revenues from the people they represent; instead we ask them to appreciate our state’s recent history lessons and cut spending instead.

BUDGET CUTS: Over $250 million previously identified

The RI Center for Freedom & Prosperity recommends that, to balance the 2018 state budget, spending cut must be implemented. Further, now is the exact time to consider even greater spending reductions so that bold, pro-growth tax cuts can benefit every Rhode Island resident and business. Only budget and tax cuts can spur the economic growth.

The obvious question then becomes: Where can be spending be trimmed without adversely affecting our people? Over recent years, the Center has put forth many specific ideas that can easily account for hundreds of millions of reductions to unnecessary spending items.

If there’s a will, there’s a way. In its 2014 Spotlight on $pending report, as well as in its 2013 recommendations on how to pay for sales tax reduction and in its 2015 PayGo policy brief on how to pay for bridge and road repairs without imposing new tolls, the Center has suggested many items for reduction or elimination. Some of the numbers or programs may have changed in the years since, but the following examples (based on the former budget value) give an indication of what can be done:

- $116 million in handouts. Legislative and Community grants; Workforce Board and Training grants; subsidies to film, television, motion pictures, and the arts industries; historic tax credits, etc.

- $44 million in other corporate welfare. WAVE and other Brookings Institution-inspired economic development corporate subsidies and tax credits.

- Up to $80 million in Medicaid and Social Services waste and fraud.

- $22 million in government operations savings. Facilities management; Convention Center (net $15M annual operating loss; level fund this loss-leader while state arranges to sell), Corrections and inmate-related expenses, excessive administrative expenses, etc.

- $30 million in personnel savings. Executive and Legislative branch staff, excessive overtime pay, non-essential departments and offices; etc.

- $6 million in government overreach. UHIP contributions, pre-K and full-day kindergarten, Commerce Corp. administration, etc.

- $8 million for shutdown of HealthSource RI. If the U.S. Congress passes its AHCA legislation, there will no longer be a need for a state-based exchange.

Additionally, newly adopted or proposed spending programs can also be reduced or eliminated.

- Up to $35 million for free college tuition.

The RI Center for Freedom & Prosperity is the Ocean State’s leading voice against the wreckage caused by our state’s progressive agenda.

As the state’s leading research organization, advancing family and business friendly values… the mission of our Center is to make Rhode Island a better place to call home – to raise a family and to build a career.

While progressives value government-centric, taxpayer-funded dependency… our Center believes in the value of hard work and the free-enterprise system.

We understand that in order for more Rhode Island families to have a better quality of life, that more and better businesses are needed to create more and better jobs.

Your donation will help us fight the union-progressive movement and, instead, advocate for pro-family, pro-business policies and values.

Please make a generous, tax-deductible gift to support our Center today!