Government officials take an oath of office to preserve the constitutional rights of their constituents. However, in Rhode Island, school board officials who approved agreements with special-interest public employee unions have effectively hidden those rights from their employees via unconstitutional collective bargaining provisions that are in direct defiance of the Supreme Court Of the United States (SCOTUS).

In 2018, the highest court in America ruled that public employees must retain power over their own paychecks. Yet, since then, many government unions in Rhode Island may have unlawfully collected dues from employees by propagating misleading language that overtly shields them from knowledge of their rights.

The landmark June 2018 US Supreme Court decision in the Janus v AFSCME case opened the door to worker freedom in America. But some of the old political machines were taken aback, especially government employee unions at the state and local level. SCOTUS ruled that no longer could a public employee be mandated to pay union “dues”, “Association fees”, “agency fees”, or “shop fees” as a condition of their employment.

Under the weight of this ruling, most public employee unions across the country, reluctantly realizing the great financial and legal risk of non-compliance, immediately amended their policies and subsequent contract agreements to comply with the new law … such that any dues payments could only be collected once the employee affirmatively provided clear authorization … but not so for many unions in Rhode Island.

According to the Mackinac Center in Michigan, one of nation’s top legal and public policy experts when it comes to government unions, Rhode Island’s rate of non-compliance with the Janus ruling looks to be among the highest in the country. The extent to which blatantly anti-Janus-constitutional provisions still exist in many teacher union Collective Bargaining Agreements (CBA) is alarming.

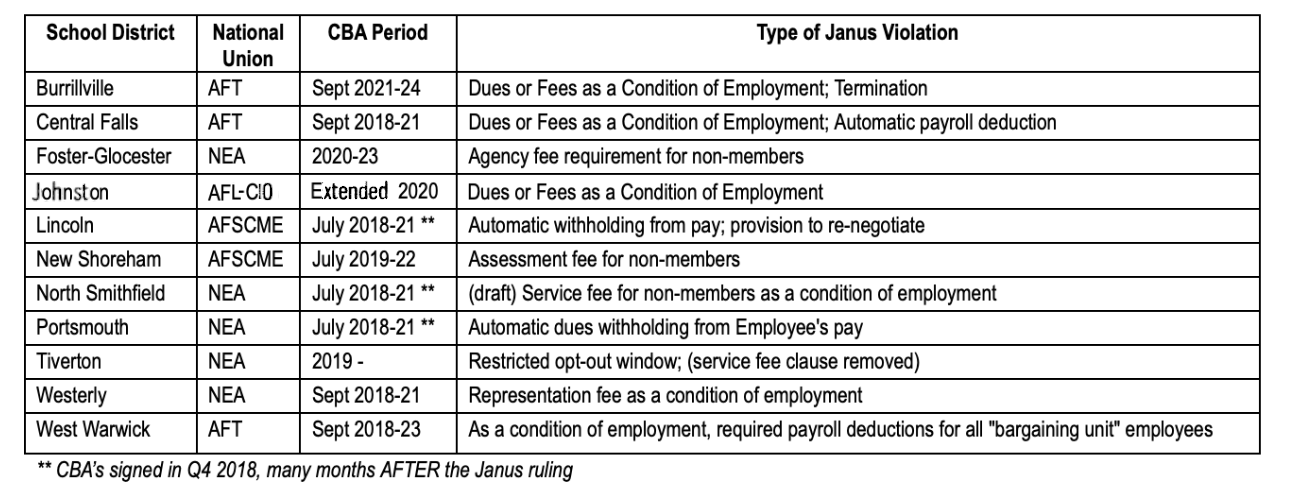

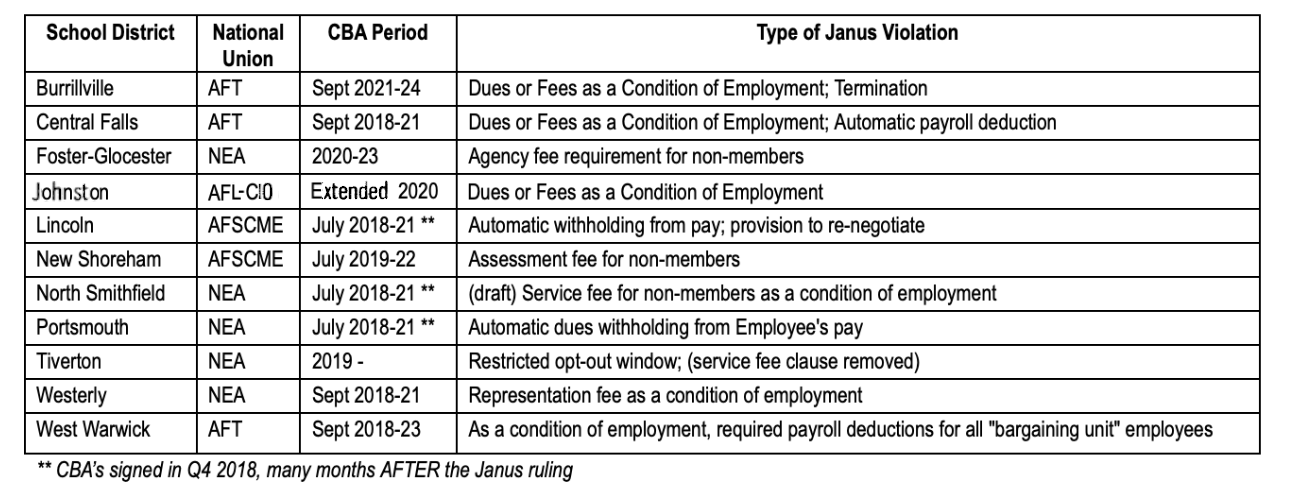

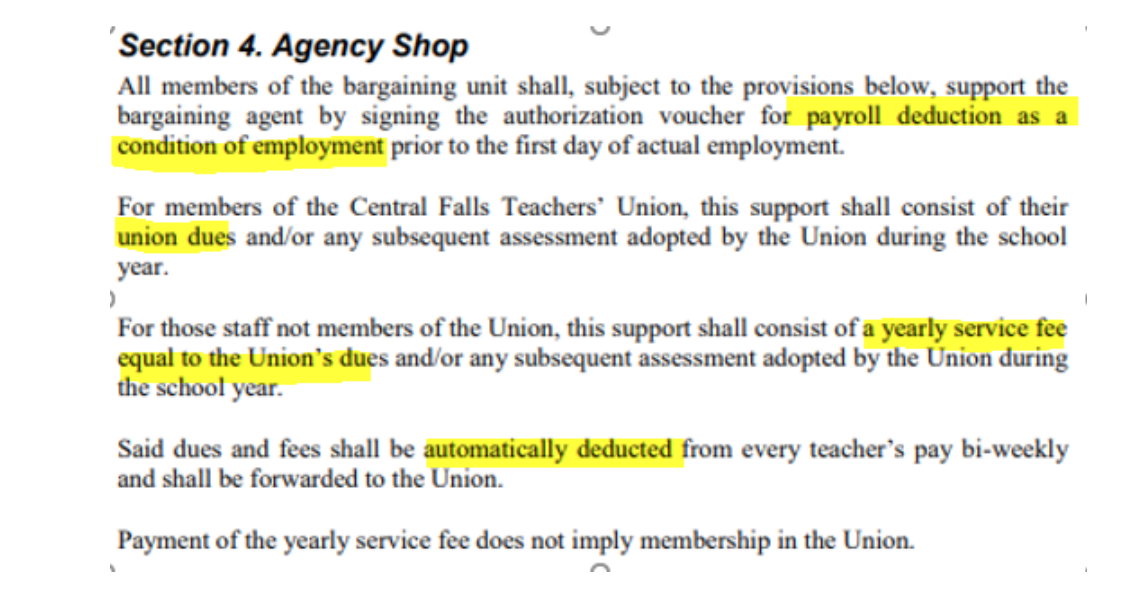

An initial review of about three dozen collective bargaining agreements with local school districts in Rhode Island reveals an alarming number – eleven (more than 1 in 4) – that were signed or put into effect after the Janus ruling, contained dues or fees mandate provisions that clearly defy the Supreme Court’s ruling … provisions that are legally unenforceable.

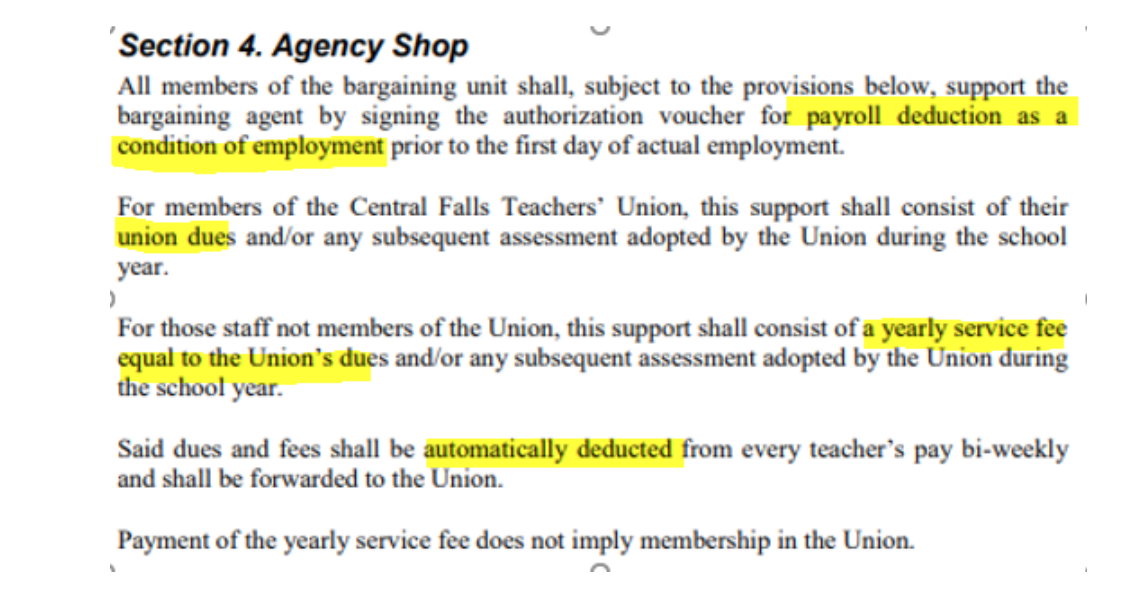

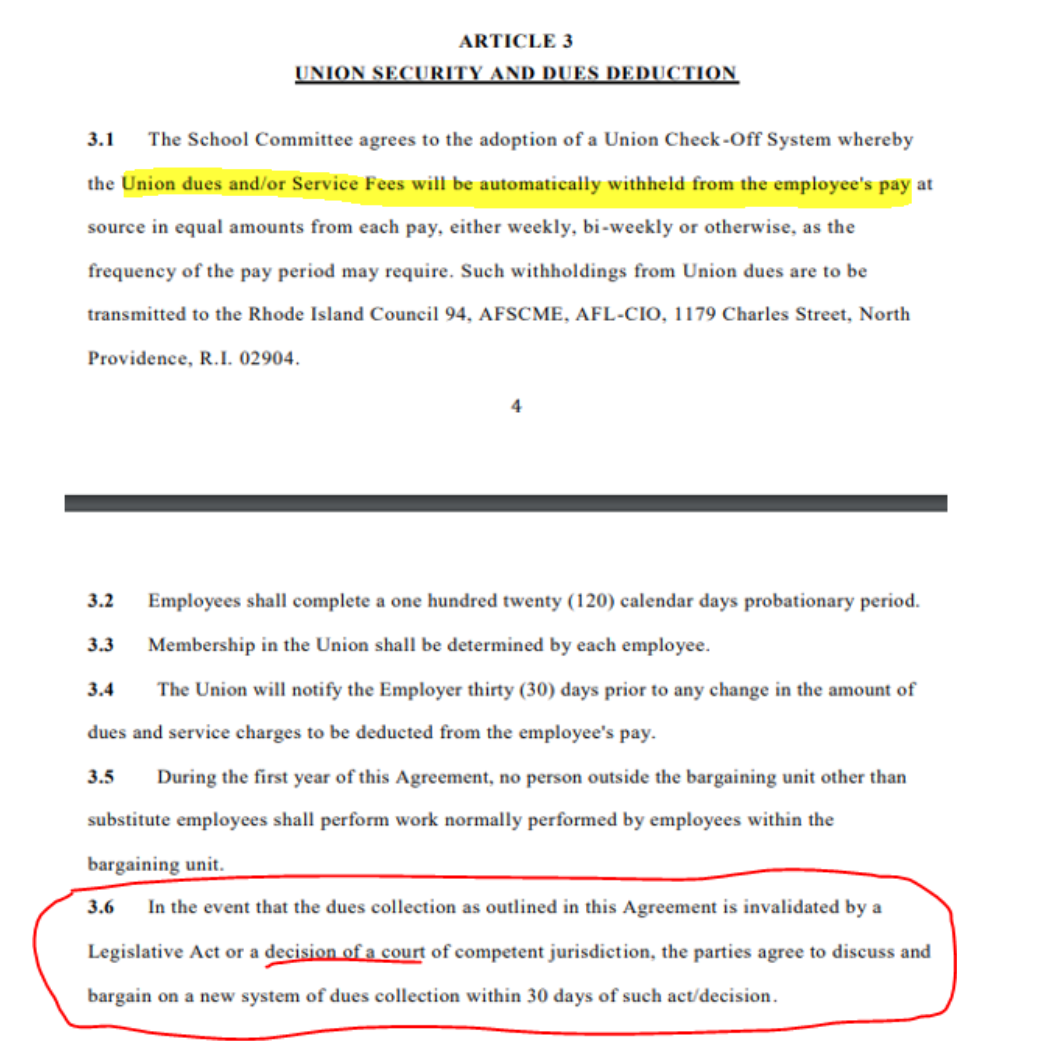

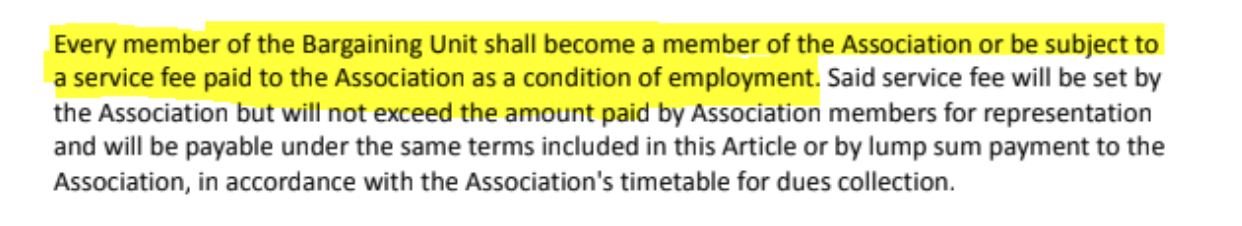

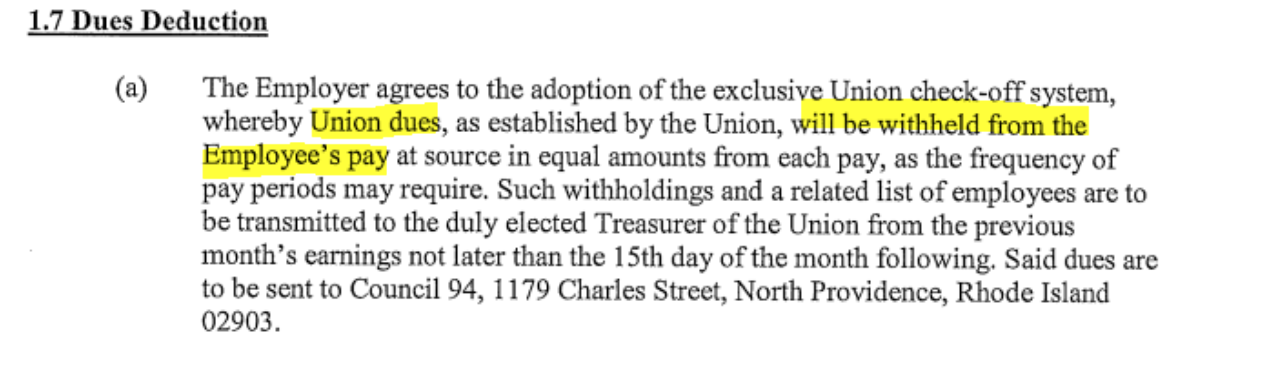

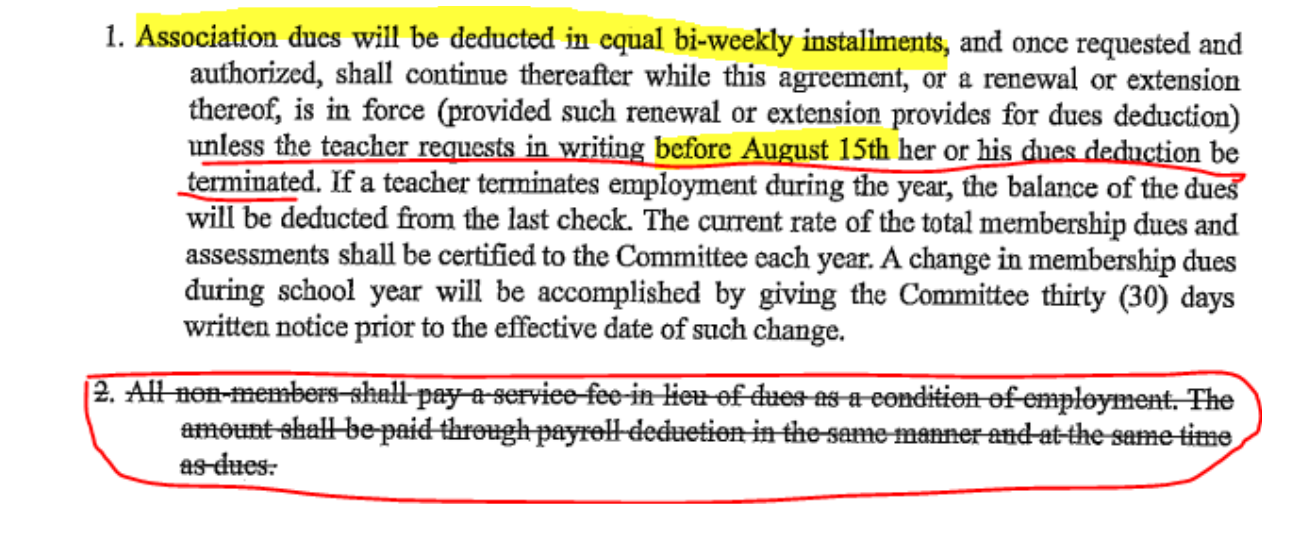

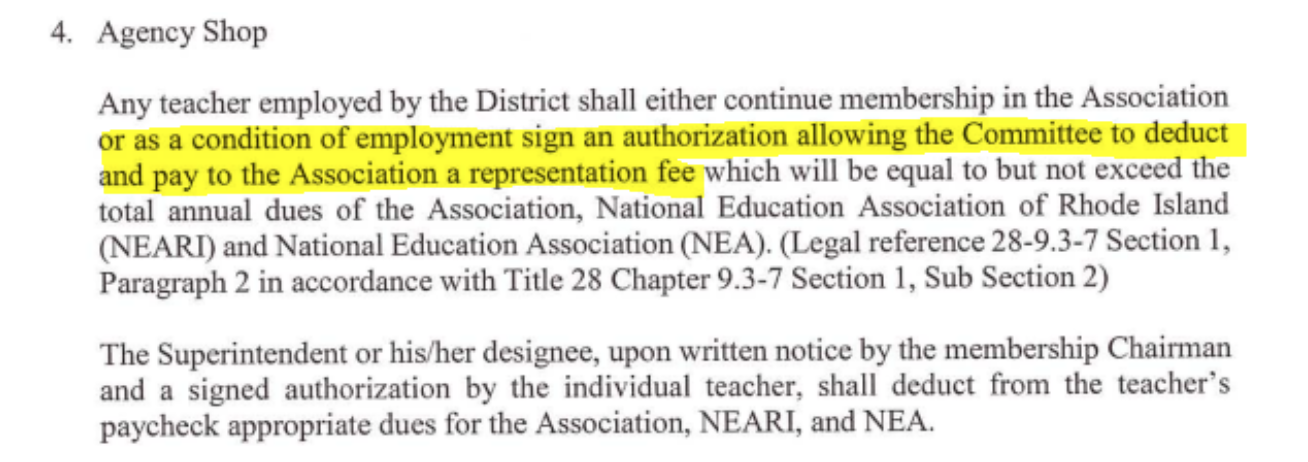

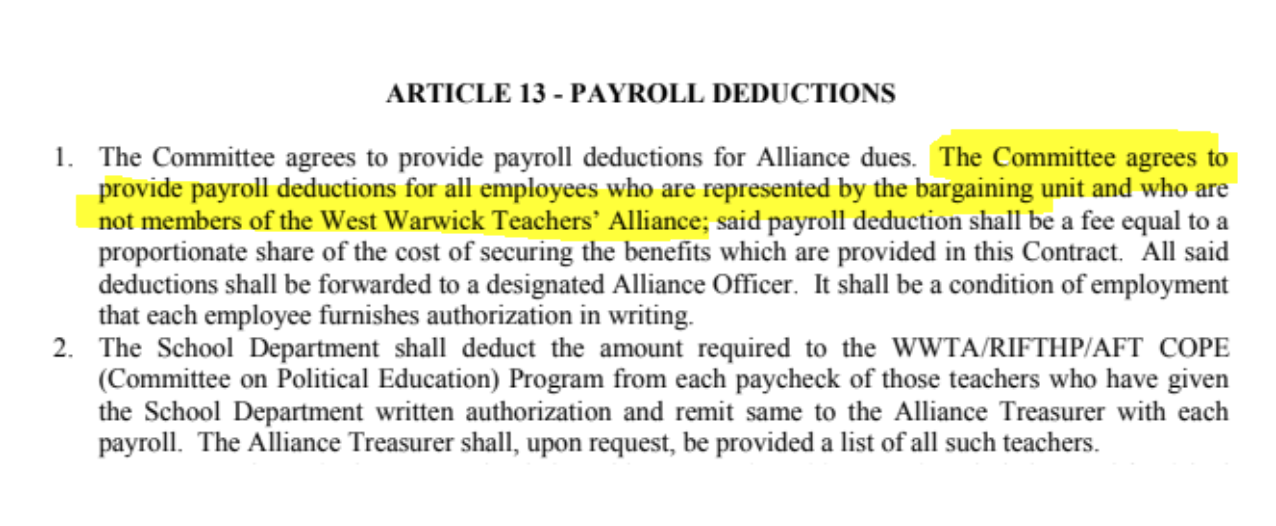

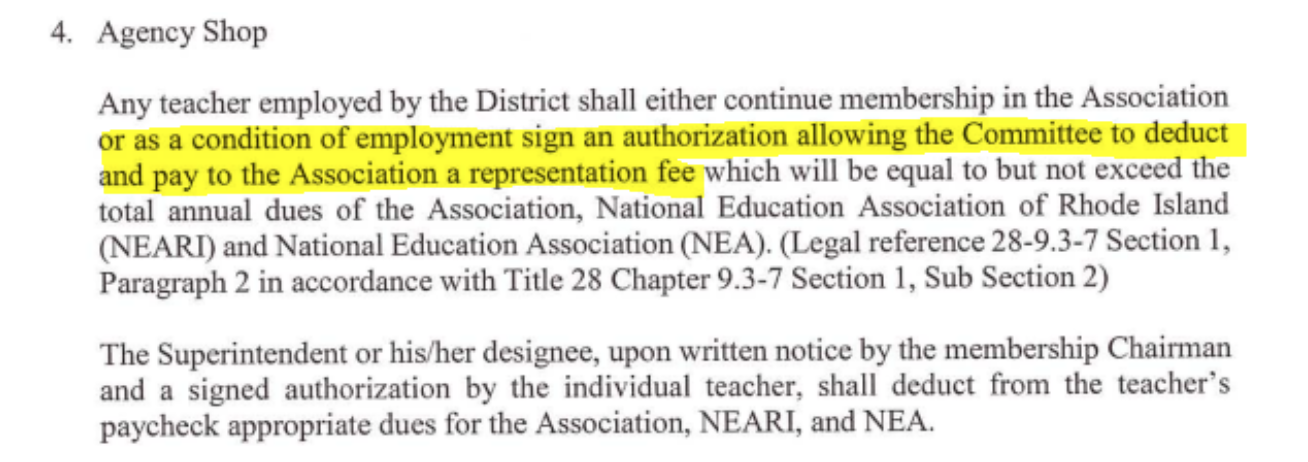

Types of language clearly violating the Janus Supreme Court ruling that were found in the eleven Rhode Island CBAs with local chapters of the NEA, AFT, AFL-CIO, and AFSCME … unlawful provisions that remained in effect for years after 2018 … can be summarized as including passages that:

- Require automatic deduction of dues or fees from employee paychecks without their expressed consent

- Require payment of dues or fees as a condition of employment

- Limit the union opt-out time-window for employees

The table below summarizes the unlawful language of offending school districts (supporting details appear as an Appendix at the end of this report:)

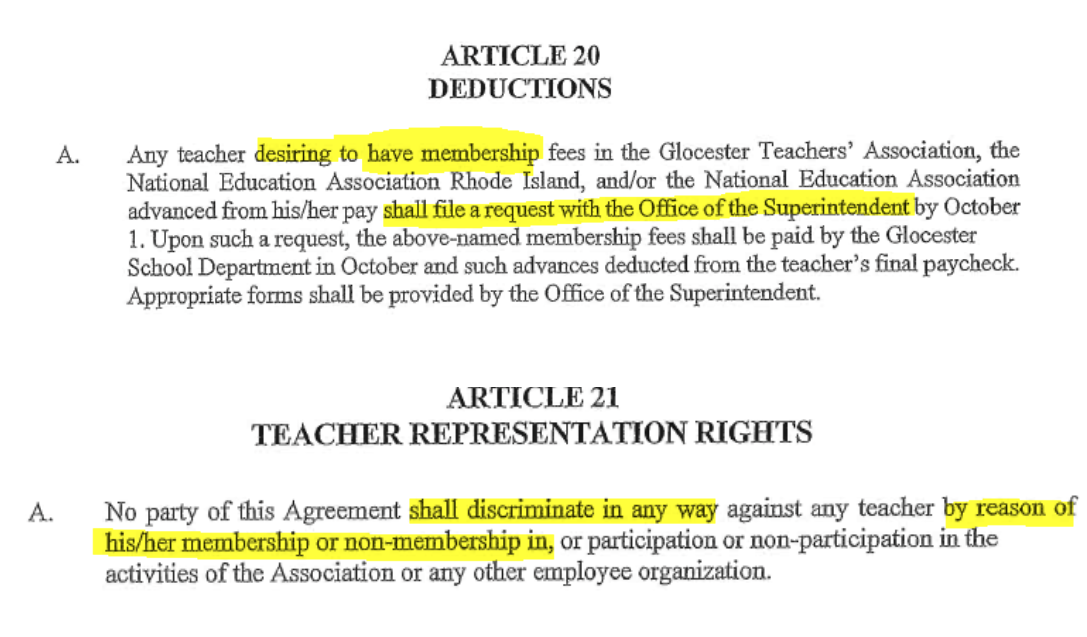

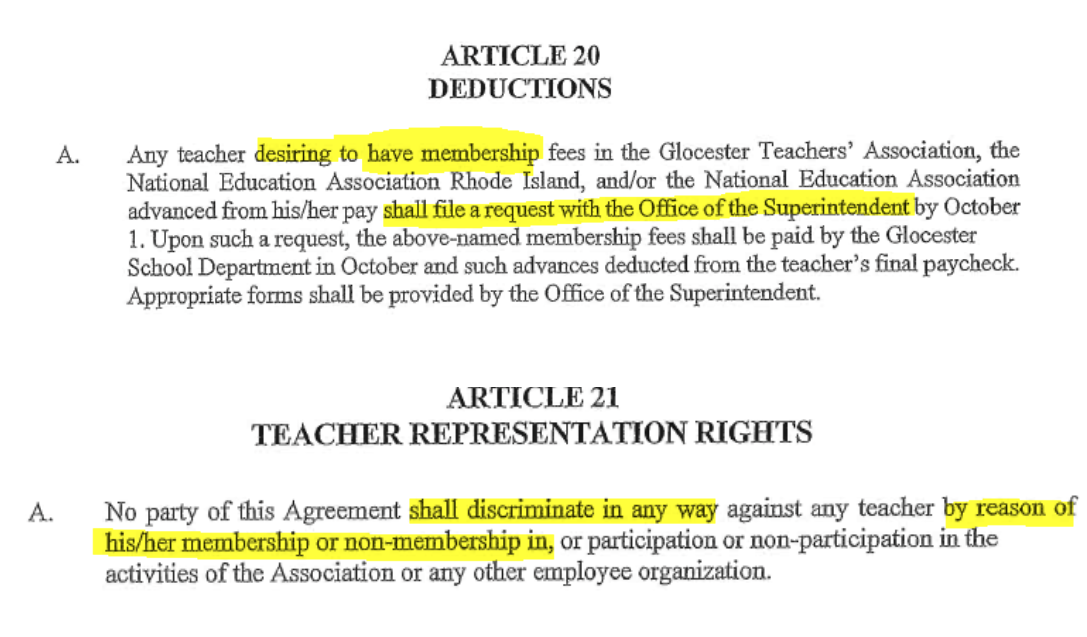

As an example of what a properly worded CBA should look like, post-Janus, we look to provisions in the agreement between the Glocester K-5 school district and the Glocester Teachers’ Association for the time period July 2019 to June 2022:

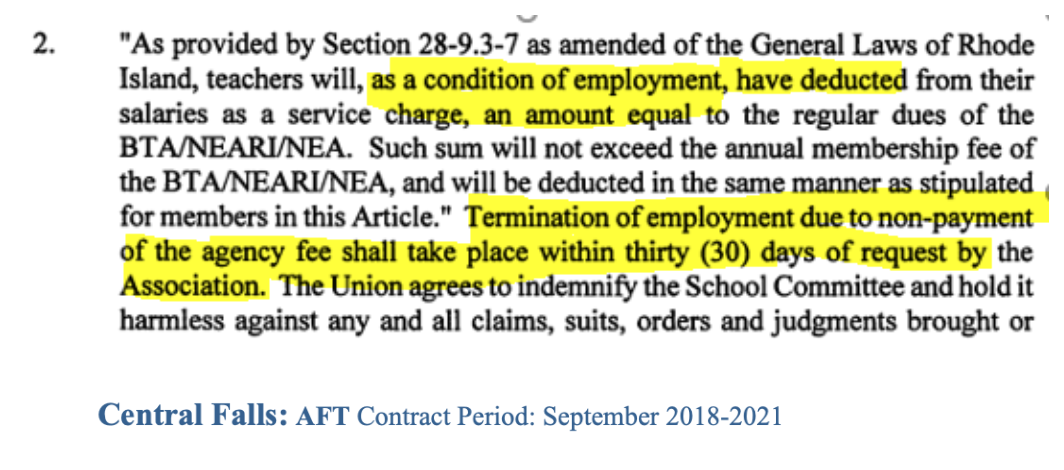

The Glocester school district maintained the above Articles 20 and 21, post-Janus, but appropriately REMOVED the following provision that appeared in the district’s pre-Janus CBA:

As national examples of how post-Janus federal court cases compelled government unions to appropriately modify their dues/fees collection policies, what follows is language from two related US Third Circuit cases:

LaSpina v. SEIU Pennsylvania State Council, 985 F.3d 278, 282 (3rd Cir. 2021). After the Supreme Court decided Janus, the Union abandoned its agency-fee setup. The day the Court issued its decision, Steve Catanese, president of SEIU Local 668, wrote to Jack Finnerty of the Scranton Public Library “that the Supreme Court has ruled in Janus” and has “held public-sector employers may no longer deduct agency fees from non-consenting employees.” Supp. App. 69. Catanese’s letter instructed Finnerty to, “effective immediately, please discontinue fair-share fee deductions.” Id. (emphasis in original).

“Therefore, under Janus I, Pennsylvania’s public sector agency shop law was no longer constitutional.” Diamond v. Pennsylvania Educ. Ass’n, 972 F.3d 262, 268 (3rd Cir. 2020). Circuit law directly on point.

Other Supreme Court precedent illustrates what must be done to demonstrate employee consent. The Court has ruled that, to demonstrate consent to a waiver of constitutional rights, there must be evidence that the waiver is a “knowing, intelligent act … done with sufficient awareness of the relevant circumstances and likely consequences.” Brady v United States, 397 U.S. 742, 748 (1970). “It must also be done with “a full awareness of both the nature of the right being abandoned and the consequences of the decision to abandon it.” Moran v. Burbine, 475 U.S. 421,421 (1986) …

Per the SCOTUS ruling, before employees can consent to financially supporting a public sector union, they must know both what their rights are and the consequences of waiving those rights.

Yet, not every school district in Rhode Island was as careful to follow the law as was Glocester, as many districts continued to allow overtly unconstitutional language to remain in their post-Janus CBAs, without providing employees with the required notification of their rights.

One of the most blatant examples of such an unconstitutional provision appears in the September 2018 Westerly Teachers’ Association CBA:

How did this happen? Elected school committee members were either complicit with teacher unions in allowing such “unlawful” language to remain, or they were unwitting victims of malfeasance or ill-advice by their school committee solicitors, who are highly paid to provide accurate legal guidance.

The fact is, that for over three years, many teachers and other school district staff in Rhode Island may have been fraudulently deceived into paying union dues or association fees because of the unconstitutional language in their respective CBAs. These employees likely had dues automatically deducted from their paychecks without ever understanding that their First Amendment rights – that they could not be forced to pay part of their paycheck to their union – had been restored in 2018.

Indeed, as compared with opt-out rates nationally, Rhode Island teachers and other public employees are choosing to “opt-out” of paying union dues at rates far lower than their counterparts in other states. While states like California, Pennsylvania, New Jersey, and Massachusetts are seeing more than 15% of workers opt out of paying money to their unions, we estimate that less than 5% of Rhode Island union members have opted out. Now, we may know why.

In the majority Supreme Court decision in 2018, Justice Alito was noted that billions of dollars were likely collected by government unions nationwide in recent decades. Much of this money came from employees who never wanted to pay union dues in the first place but were forced to, because of prior legal precedent.

However, over the past three and a half years, Rhode Island unions may have similarly, yet unlawfully, collected millions of dollars in dues from employees who may have chosen to opt-out … had they not been deceived by clearly unconstitutional language.

Obvious questions must be asked, including:

- How many teachers and school staff would not have paid union dues if they had been appropriately advised of their rights? How much money was fraudulently collected by unions?

- Why do so man teacher union CBAs in Rhode Island contain such unconstitutional language?

- Why did Rhode Island school committees and teacher unions engage in such non-compliance so much more than any other state?

- Did school committee members knowingly turn a blind eye towards this malfeasance, or were they completely ignorant of these obvious violations?

- How can high-paid school committee solicitors allow such obviously unconstitutional language to be included in recent CBAs?

- Is anything comparable to this level of unconstitutionality occurring in non-teacher public employee CBA contracts in Rhode Island?

Why in some cases, does the AFSCME CBA have proper language regarding dues and fees, while the teacher contract over the same period in the same school district has unconstitutional language?

The main question this report raises … is whether or not certain public teacher unions in Rhode Island conspired to illicitly collect union dues from unwitting teachers and staff?

This is not the first time that a government entity in Rhode Island has exhibited such blatant defiance of the US Supreme Court’s Janus decision. In 2018, our Center’s MyPayMySayRI.com campaign triggered a public letter of warning from then Attorney General Peter Kilmartin, after our outreach initiative sought to educate government workers about their restored Janus rights. The letter from Rhode Island’s highest law enforcement official contained numerous unsubstantiated, unspecified, and false assertions of “misinformation” being put forth by our RI Center for Freedom & Prosperity, such as the bogus claim that we were mis-informing public employees of their rights not to join or pay union dues or fees.

Then, as now, the pattern of government officials in Rhode Island conducting the bidding of public sector unions – at both the state and local level – even to the extent of seeking to obfuscate the constitutional rights of its members … runs directly contrary to the public oaths they took upon entering office.

A review of non-school district CBAs will soon be conducted by the Center.

The following Appendix lists images the actual passages from post-Janus teacher-union CBAs in Rhode Island that contain language that does not comply with the US Supreme Court’s Janus ruling.

APPENDIX

Rhode Island School Districts with Unconstitutional Collective Bargaining Provisions

Burrillville: NEA Contract Period: September 2021-2024

Page-40: https://docs.google.com/viewer?a=v&pid=sites&srcid=YnNkLXJpLm5ldHxob21lfGd4Ojc1NTMwZjU2M2U5MDhiMQ

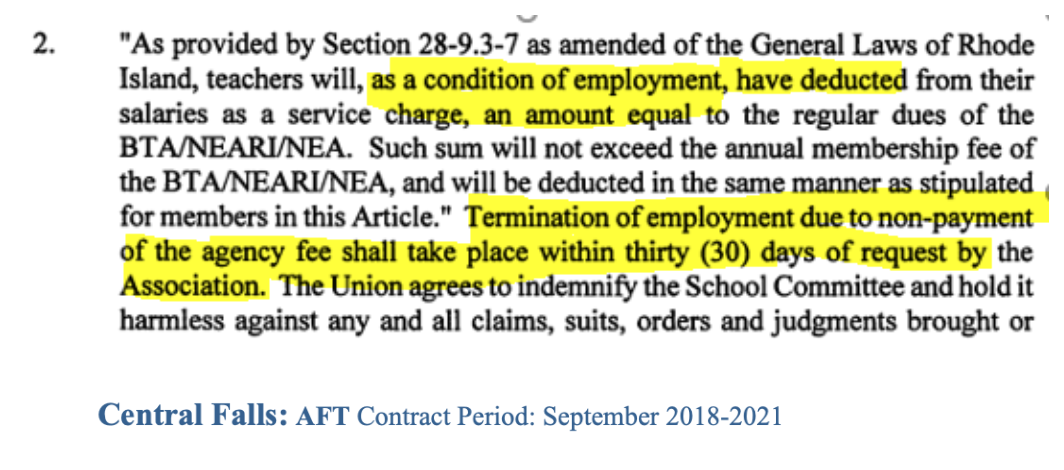

Page-5: https://core-docs.s3.amazonaws.com/documents/asset/uploaded_file/236104/CF_CBA_18-21_FINAL_FORM.pdf

Foster-Glocester: NEA Contract Period 2020-2023

Page-29: http://www.fg.k12.ri.us/common/pages/DisplayFile.aspx?itemId=9841126

Johnston: AFL-CIO Local 808 Contract period 2017-2020, extended in 2020 by the school district

Pages 4-5: https://www.johnstonschools.org/common/pages/DisplayFile.aspx?itemId=20171014

June 2020 Johnston School District Minutes

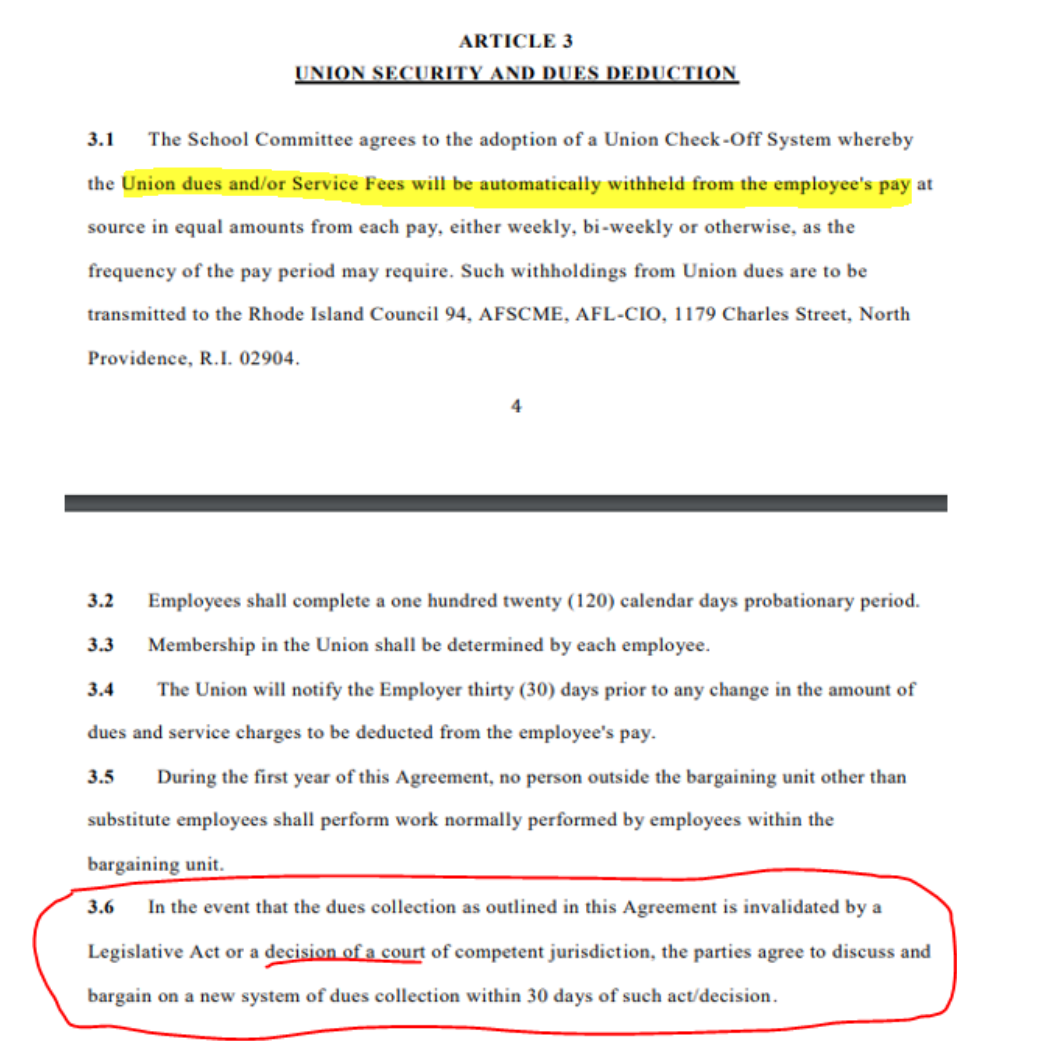

Lincoln: AFSCME Contract Period September 2018-2021

Page-4: https://www.lincolnps.org/cms/lib/RI50000681/Centricity/Domain/44/L2671-contract-2018-2021-02-07-19-FINAL.pdf

New Shoreham: AFSCME Contract Period 2019-2022

Page-2: https://4.files.edl.io/4ef8/11/15/19/153226-ac2437cb-2ef2-43d3-8fb7-ab0bbf4cb0cf.pdf

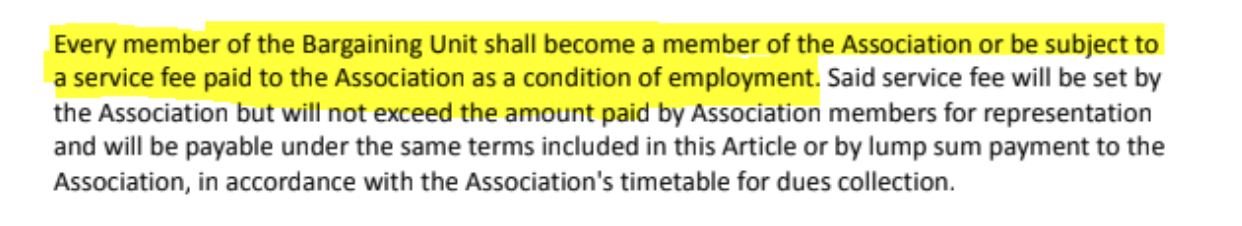

North Smithfield: NEA Contract Period 2021-24

Page-6: NSTA Collective Bargaining Agreement

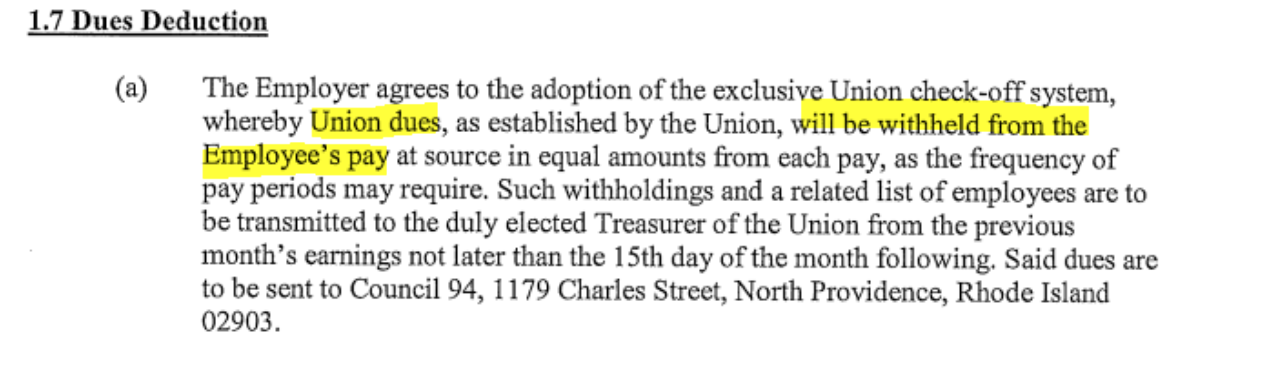

Portsmouth: AFSCME Contract Period September 2018-2021

Page-2:

https://core-docs.s3.amazonaws.com/documents/asset/uploaded_file/1355692/Council_94_Contract_7.1.18_-_7.30.21.pdf

Tiverton: NEA Contract Period; 2019 –

Page-9: http://www.tivertonschools.org/common/pages/DisplayFile.aspx?itemId=8558123

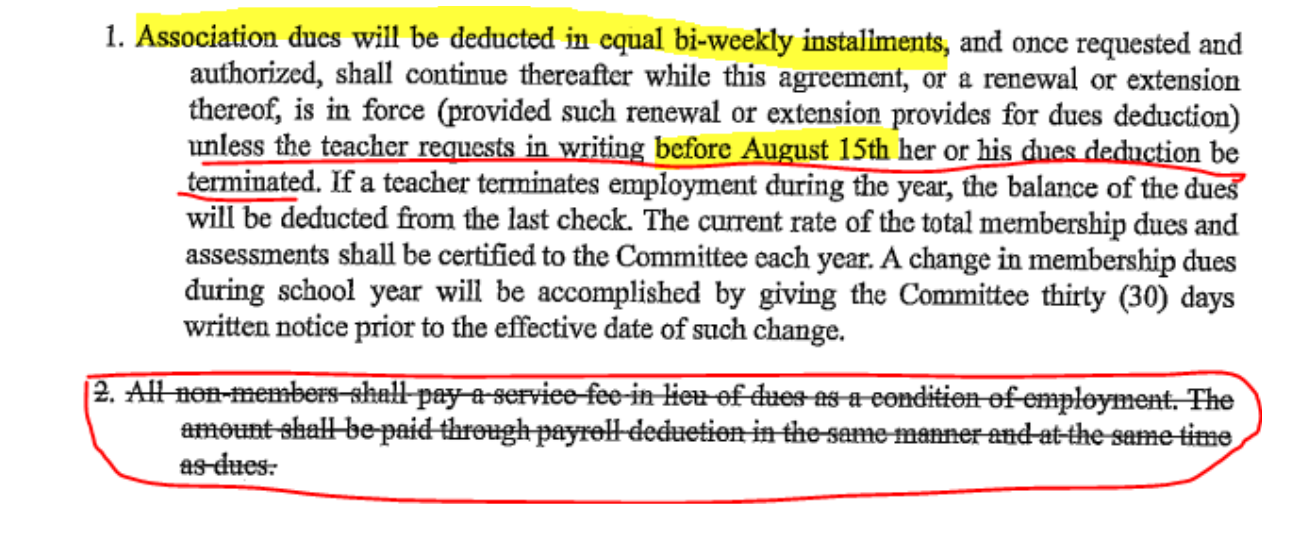

Westerly: NEA Contract Period September 2018-2021

Page-5: https://drive.google.com/file/d/1V6e4ChNvhLkp6-Y0zqPUdieauxOzAMvm/view

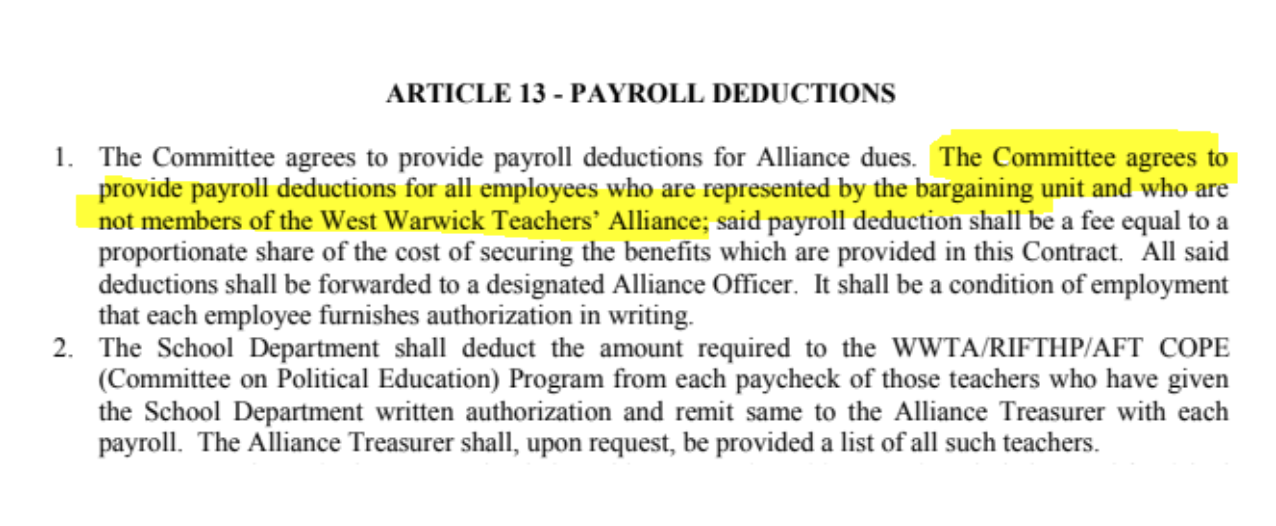

West Warwick: AFT Contract Period September 2018-2023

Page-21: https://drive.google.com/file/d/1NdyhtJYJb0SibVVm0BXmthzTkehxDtjU/view